Atlas Renewable Energy announces USD $114.4 million financing of Uruguayan solar energy plants

Miami, FL, July 2, 2018 – Atlas Renewable Energy announced today the closing of long-term financing for its El Naranjal and Del Litoral solar PV projects in Salto, Uruguay. The financing was secured through a US Private Placement with several international investors, placed by DNB Markets, Inc. and the Inter-American Investment Corporation (IDB-Invest). The deal was arranged as an A/B Bond structure including a senior and a subordinated note, with IDB-Invest as the lender of record.

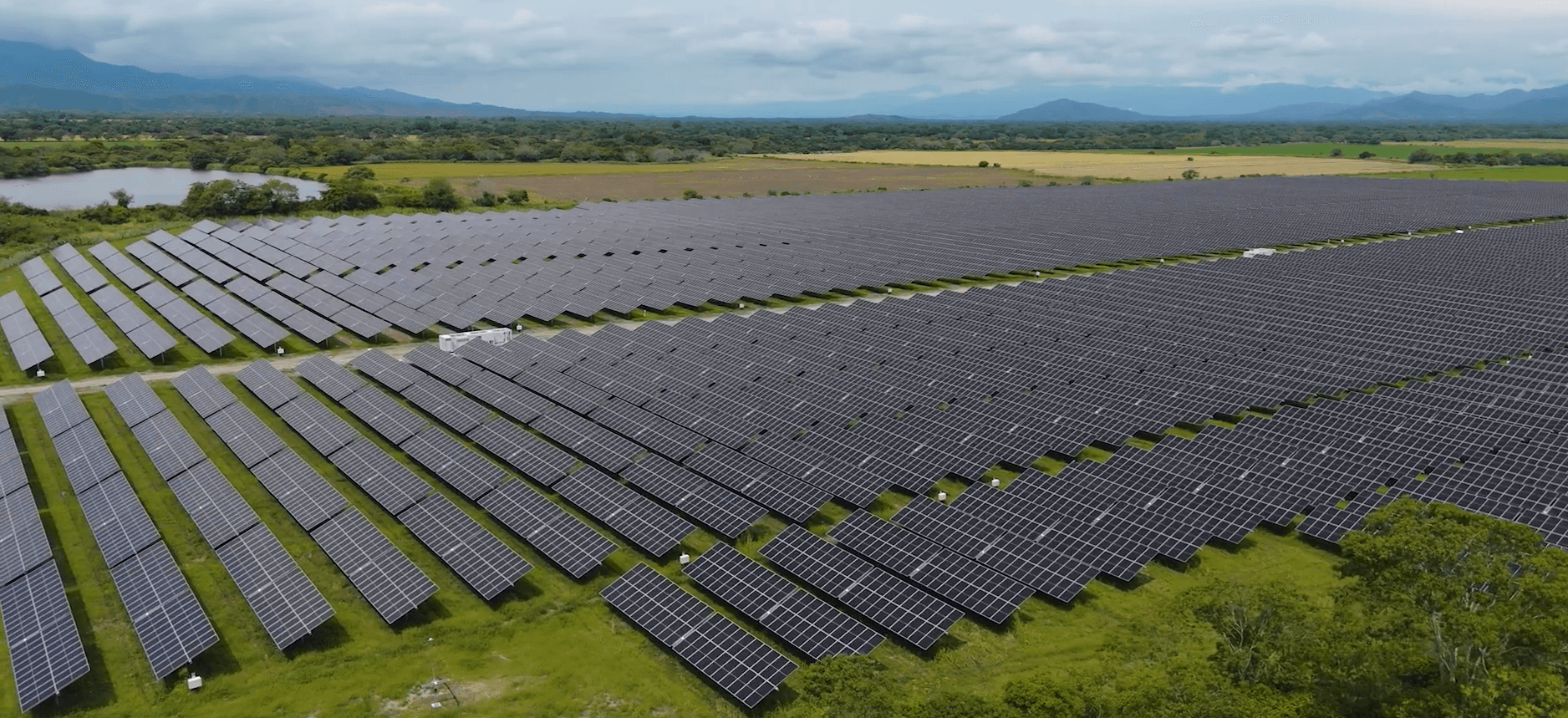

The El Naranjal and Del Litoral projects have been successfully operating across 190 hectares of land in northern Uruguay since September 2017 and June 2017, respectively. The collective 238,720 solar panel modules have a combined installed capacity of 75.8MWp and produce 144.3 GWh per year. Each project has a 30-year power purchase agreement with the state-owned company, Administración Nacional de Usinas y Trasmisiones Eléctricas (UTE), and will supply UTE with 100% of their energy generation until December 2043 (25.5 years remaining).

As a leader in clean energy across Latin America, Atlas Renewable Energy estimates that the operation of the projects avoids the emission of 55,500 tons of CO2, annually, while powering 45,959 houses.

The CEO of Atlas Renewable Energy, Carlos Barrera stated, “We are very pleased to close this transaction with great financial institutions backing us. We believe solar energy will continue to play a crucial role in Latin America’s energy growth needs, because its inherent sustainability credentials combined with its increasing cost-competitiveness. As the renewables sector grows, Atlas will continue striving to differentiate ourselves with sector innovation in every facet of our business, including capital structuring.”

Mr. Barrera’s comments were echoed by Emilio Fabbrizzi, managing director and head of Project Finance, Latin America at DNB Markets, “This is DNB Markets’ third green project bond transaction in Uruguay, and the second this year that we successfully placed in the debt capital markets, under an innovative financing structure together with IDB Invest. In this transaction we were able to push the envelope and place not only an investment grade senior tranche, but also a sub-investment grade subordinated tranche with private investors, both at very attractive rates and long tenors. This was made possible given a first-class shareholder with experience in the renewable energy sector, in conjunction with a fully-contracted off-take agreement from UTE with 25.5 years remaining. The success of the transaction continues to demonstrate DNB’s capabilities and experience in Latin America.”

Gian Franco Carassale, principal investment officer at IDB Invest also commented that, “The senior and subordinated bond issuances for Naranjal and Del Litoral are great examples of how the capital markets are an increasingly important solution for project finance in Latin America and the Caribbean. This also shows how the B-Bond program from IDB-Invest can mobilize investors for non-investment grade issuances and, in turn, bring solutions to the market that can complement the increasingly scarce long-term bank financing. We are pleased to begin a relationship with Atlas Renewable Energy in this first-of-a-kind transaction, with hopefully many more to come.”

As solar energy production is on the rise, and the sector is estimated as a $160.8bn global industry, Atlas Renewable Energy looks to continue positioning itself as the leading player across Latin America.

About Atlas Renewable Energy

Atlas Renewable Energy (Atlas) is an operating renewable energy company that develops, builds, and operates renewable energy projects with long-term energy contracts across Latin America. Atlas holds a portfolio of 800MW of contracted projects in development, construction, or operational stages, and aspires to grow an additional 1.5GW over the coming few years.

Launched in early 2017, Atlas includes an experienced team with the longest track record in the solar energy industry in Latin America. The company is recognized by its high standards in development, construction, and operation of large-scale projects.

Atlas Renewable Energy is part of the 4 Fund founded by Actis, a leading private equity investor in the energy sector of emerging markets. Actis has allocated more than $ 600 million of equity in Atlas Renewable Energy to invest in long-term renewable energy contracted projects.

Atlas’s growth is focused on the main emerging markets and economies of Latin America, using its proven development, commercialization and structuring know-how to bring clean energy to the region. By actively engaging with the community and stakeholders at the center of its project strategy, Atlas works every day to provide the world with a cleaner future.

For more information, please visit www.atlasrenewableenergy.com.

Media Contacts

Diana Castellanos, Communications Manager, Atlas Renewable Energy

Email: [email protected]

Kelsey Flitter, Burson-Marsteller

Email: [email protected]

Share This Entry