Renewable Energies as Key Players in CFO Strategies

CFOs are leading a revolution toward sustainability: Renewable energy purchase agreements have become central elements of their financial and environmental strategies.

The role of the Chief Financial Officer (CFO) has undergone a significant transformation, largely driven by digital disruption and the ascendance of the financial sector. The ability to engage with all key stakeholders related to the company and to comprehend regulatory frameworks is crucial in a CFO’s decision-making processes.

The CFO is no longer merely a technical figure; their role has diversified, and they are now hybrid and strategic professionals. Instead of focusing solely on numbers and finance, CFOs are expected to possess soft skills that foster collaboration and empathy. This is corroborated by a recent Forbes article, which characterizes the CFO as the “co-pilot” to the CEO of a company.

Today’s CFOs face the challenge of managing traditional tactical and strategic areas and also demonstrating flexibility and agility to anticipate situations proactively. This adaptability is essential given the increasing complexity of the business landscape.

In an era of accelerating digitalization, professional services firm EY in Latin America underscores the importance for CFOs to adopt new technologies to drive operational efficiency and profitability in corporations. Essentially, CFOs are increasingly responsible for value creation, a key tenet for business sustainability

ESG Policies: A Cornerstone of a CFO’s Decision-Making

Financial leverage has long been crucial for corporate growth. However, today there is an additional factor: companies’ access to credit is increasingly contingent upon their commitment to ESG (Environmental, Social, and Governance) policies.

A few years ago, a company’s environmental or social sustainability was only evaluated by credit rating agencies. Today, institutional investors demand it. “Some of the major asset managers, especially those with passive management funds (such as Vanguard, State Street, BlackRock) as well as some with active management, have established specialized teams and developed proprietary methodologies to assign their own sustainability ratings,” states BBVA.

Investors now assess companies’ sustainability policies. Adherence to these policies will facilitate more effective participation in capital markets, according to the Colombian Business Council for Sustainable Development (Cecodes – Consejo Empresarial Colombiano para el Desarrollo Sostenible). Consequently, ESG principles must be at the core of any CFO’s strategy.

What financial instruments are associated with sustainability measures? “There is an increasing array of products for companies that meet ESG standards,” says Banco Santander. Four of these products are:

– Sustainable Investment Funds: Organizations that allocate capital to projects after evaluating various criteria, such as efforts in innovation and the improvement of energy efficiency or social conditions.

– Green and Social Bonds: Debt securities aimed at financing environmentally or socially responsible projects.

– Social Venture Capital: Funds that invest in companies whose mission is to solve social or ecological challenges. Social venture capital investors expect both financial returns and social or environmental benefits.

– Green Loans: Financial products designed to fund projects that help preserve the environment, such as the production of more energy-efficient appliances or less-polluting vehicles.

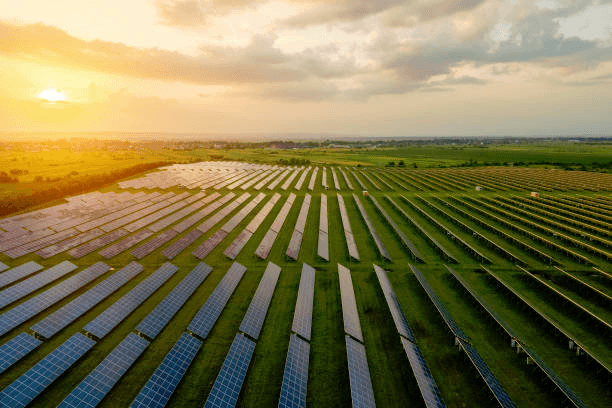

Corporate Renewable Power Purchase Agreements: A Pivotal Consideration for CFOs

Initiatives promoting the energy transition (shifting from fossil fuels to clean energy) are becoming increasingly relevant for investors. The novelty is that they are gradually becoming significant for consumers as well.

One example is that the reduction of CO₂ emissions will be decisive for trade with Europe for some companies. Indeed, the European Commission is in the process of adopting a Carbon Border Adjustment Mechanism (CBAM) that would prevent the importation of goods produced with higher CO₂ emissions than permitted in EU countries for domestic consumption, one of the most stringent standards in the world.

Consequently, if a copper mining company’s carbon dioxide emissions exceed the environmental policies of the European Union, the extracted copper cannot be sold to any of the 27 EU member states. In light of this mandate, many Latin American corporations will need to augment their consumption of renewable energy sources, which generate lower emissions.

Are CFOs aware of these changes? Javier Bustos believes so. Bustos is the executive director of the Association of Unregulated Electricity Customers (ACENOR), which represents Chilean companies considered ‘free clients’ in terms of electricity service (i.e., their connected power exceeds 500 kW, and they can self-generate their electricity or contract supply directly from generating companies).

“Companies are increasingly seeking to access renewable electricity supply [(through bilateral power purchase agreements (PPAs)], with the objective of achieving their own carbon footprint reduction goals, as well as to compete internationally,” highlights Bustos, referring to the lower prices that can be found in the renewable energy sector.

“Recently, we have seen how large industrial and mining electricity customers have renegotiated or signed new contracts to ensure they receive renewable supply,” affirms Bustos. “At ACENOR, we estimate that at least 60% of the energy contracted by our associates is already renewable, and it continues to grow each year.”

For Bustos, it is advisable for companies qualifying as free clients “to continue driving the procurement of renewable energy, making the CFO’s perspective highly relevant for incorporating this type of supply into the consumption portfolio.”

Stability, competitive prices, and decarbonization to achieve ESG goals: ACENOR’s executive director observes that large companies prefer to enter into PPA contracts rather than be exposed to the fluctuations of marginal market prices or depend on the supply from a utility.

For what terms? “Approximately, one-third of free contracts in Chile are for at least 15 years in duration. The rest, mostly, are contracts between 5 and 10 years in duration,” he said.

Key Points: A Practical Guide to Sustainability Challenges

In summary, it is advisable for the CFOs to consider ESG criteria when formulating their strategy. An article published by the consulting firm PwC outlines four dimensions of these executives’ roles and their relationship with sustainability policies:

– Strategic Visionary: The CFOs need to understand and guide the relationship between people, ecosystems, and profitability to identify sustainability risks and opportunities, integrating them into a long-term strategy.

– Inclusive Collaborator: The CFOs must know how to build a network between business units, suppliers, vendors, and other stakeholders to maintain a commitment to sustainability.

– Transformation Catalyst: The CFOs should align the business strategy, the company as a whole, and its culture through a common sustainable agenda.

– Steadfast Communicator: The CFOs have access to the organization’s financial and non-financial information; thus, they need to create a credible sustainability program with reliable data.

Another central aspect is that CFOs need to identify all relevant stakeholders of a company, beyond shareholders.

“Today, CFOs recognize that not only shareholders demand financial and non-financial information related to ESG issues; this is also demanded by parties that have an internal or external impact on the organization,” asserts PwC.

Conclusion

Environmental and social imperatives demand a robust commitment from corporations in devising ESG (Environmental, Social, and Governance) policies. Executives must cultivate the capacity to adapt swiftly to emerging trends, including facilitating the energy transition.

In this regard, renewable energy supply agreements are a strategic instrument for CFOs to achieve environmental objectives, such as reducing carbon dioxide emissions.

Clean energy power purchase agreements not only aid companies in attaining their ESG goals (which will grant them greater access to financial instruments and, in many cases, enhance their reputation among consumers), but they also represent enduring economic savings due to their stable, long-term agreements at competitive rates.

This article was created in partnership with Castleberry Media.. At Castleberry Media, we are dedicated to environmental sustainability. By purchasing Carbon Certificates for tree planting, we actively combat deforestation and offset our CO₂ emissions threefold.

Share This Entry